CoFR vision for the future of New Zealand’s payments

CoFR’s vision of the future of New Zealand’s payments landscape is “Reliable and efficient payments that better meet the evolving needs of all New Zealanders.”

Payments play a fundamental role in supporting a stable economy and in our everyday lives. In setting out this vision, CoFR is taking a leadership role in the future of New Zealand’s payments, and ensuring there is a common objective, clear communication, and ultimately better money and payment services for all New Zealanders.

The payments landscape continues to evolve as customer and merchant expectations shift and new providers seek entry, at the same time the industry is considering implementing real-time payments. However, there is more to be done to ensure that New Zealanders evolving needs at met. The payments landscape needs to be innovative, inclusive and responsive to changes. It must also be reliable and efficient, this requires ongoing efforts to ensure resilience, safety, compliance, openness and competition.

CoFR agencies are committed to ensuring they are co-ordinated and aware of how their respective objectives and mandates will contribute to the vision. CoFR also seeks to identify opportunities for enhanced co-ordination, collaboration, and monitoring activities. Going forward, CoFR will be assessing the payment landscape against the vision and developing and monitoring a roadmap of activities. CoFR is in the process of scoping the deliverables and timeframes for this roadmap and welcomes any feedback.

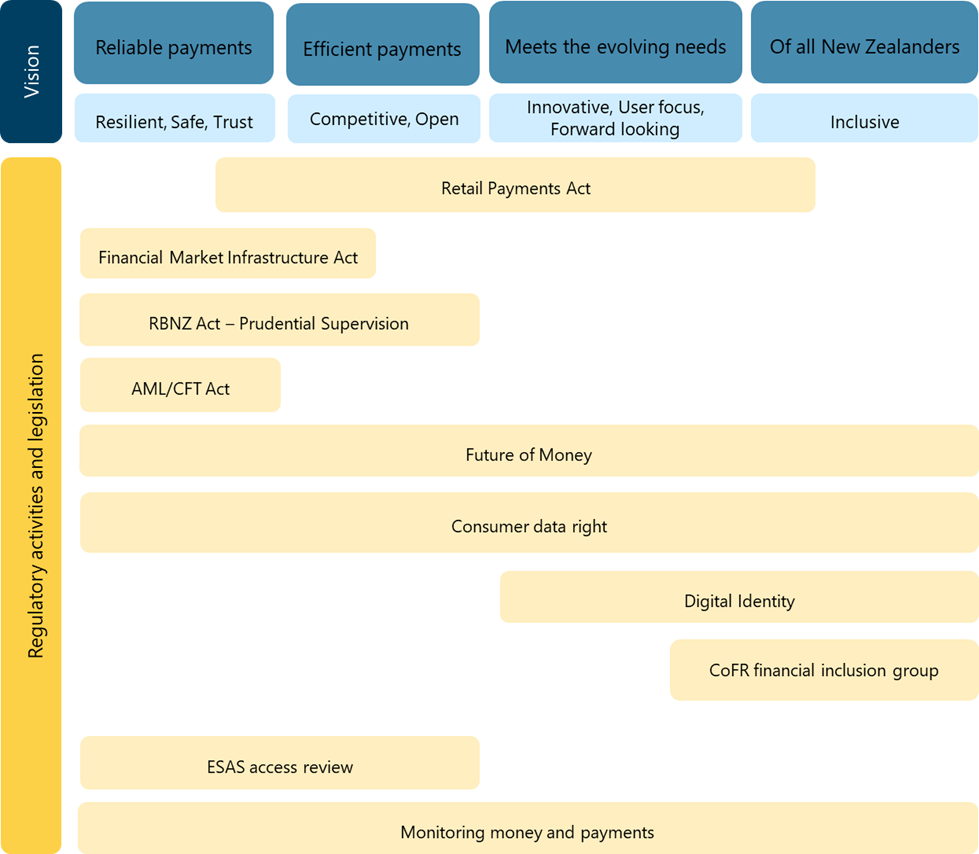

Current regulatory initiatives that support the vision

New Zealand has several pieces of legislation that provide regulatory powers to important aspects of the payment landscape, in addition there are several policy programmes of work that address additional aspects of the landscape or that can enable better and more innovative payments.

- The Reserve Bank of New Zealand (RBNZ) is leading a future of money programme, which includes redesigning the cash system and investigating a central bank digital currency issued to the general public. The RBNZ is also monitoring money and cash. This work aims to ensure that the money and payments systems are reliable and efficient and support inclusion and innovation. RBNZ has also been consulting on the access requirements for its Exchange Settlement Account System.

- The Retail Payment System Act 2022, administered by the Commerce Commission, focuses on promoting competition and efficiency in the retail payment system for the long-term benefit of merchants and consumers in New Zealand. Currently the Commission is focused on making pricing for merchants and consumers reasonable and transparent, particularly merchant service fees and their flow through to payment surcharges. The Commission is also focused on improving its understanding and transparency of the retail payment system, including investigating the barriers limiting innovation and new payment options being available to consumers and merchants.

- RBNZ and FMA are jointly working to implement the Financial Market Infrastructures Act 2021. This legislation provides comprehensive regulatory, supervisory, enforcement and crisis management powers that underpins the reliability of the payments landscape and other systems that enable financial market transactions. The RBNZ is the sole regulator of Payment Systems.

- There are also several policy initiatives that have the potential to be key enablers for achieving the vision. In particular, the Consumer Data Right (led by the Ministry of Business, Innovation and Employment) will support competition and innovation outcomes in the payments sector, while safeguarding customer data. In a similar vein, the Digital Identity Services Trust Framework (led by the Department of Internal Affairs) will make it easier to share personal information digitally and support greater choice for New Zealanders.

Figure 1 provides a high-level summary of how current regulatory powers and initiatives contribute towards CoFR’s vision for the future of New Zealand’s payments. This figure will be refined and updated as work on the roadmap to the vision progresses.

Figure 1: Aligning CoFR activities to the vision

Description of the payments landscape

A payment occurs when funds are transferred in exchange for goods or services. Every payment requires a network of systems, services and products to work together. These systems, services and products are provided by a range of different entities. Collectively, these entities and arrangements are referred to as the payments landscape. For illustration, Figure 2 depicts a handful of these entities.

Figure 2: Selected entities in the payment landscape

Source: New Zealand’s Payment Landscape: A Primer. (rbnz.govt.nz)

For example, a payment made with a contactless card requires:

- a bank account to send the money from (payer account),

- a bank account to receive the money (payee account),

- a device to interact with the card if instore, or an online portal to put the card details into,

- a system to send the payment message between the two banks,

- a card scheme to send the rules of the payment,

- and a series of rules and systems between the banks and the RBNZ to ensure the money moves from the payers account to the payee’s account.

Each of these components is provided, owned, and operated by different entities who all work together.

For more information on the New Zealand payment landscape see How payments work | Payments NZ and New Zealand’s Payment Landscape: A Primer. (rbnz.govt.nz)

27 July 2023