News archive

Read the latest stories

Independent review of CoFR underway (Quarterly Statement – June 2025)

CoFR Heads met on 4 June to discuss an independent review of the Council of Financial Regulators (CoFR).

10 June 2025

Quarterly Statement by the Council of Financial Regulators – March 2025

The Council of Financial Regulators (CoFR) held its quarterly meeting on Monday 24 March 2025. The meeting was chaired by Financial Markets Authority Chief Executive Samantha Barrass. The Council discussed the key external factors that could impact the financial system, noting in particular the rapid developments in artificial intelligence and ongoing geopolitical uncertainty.

4 April 2025

Photo credit: rawpixel.com

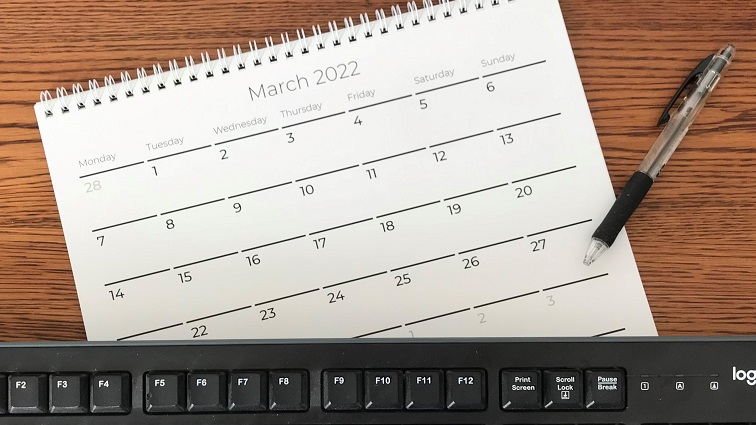

Regulatory Initiatives Calendar - Q1 2025

The Council of Financial Regulators has released the Q1 2025 update to the Regulatory Initiatives Calendar for New Zealand’s financial sector. This document is produced to help the sector understand the aggregate picture of regulatory initiatives from CoFR members that are either planned or under way. The next update is planned for the end of June.28 March 2025

Quarterly Statement by the Council of Financial Regulators – December 2024

The Council of Financial Regulators (CoFR) held its quarterly meeting on Thursday 12 December 2024. The meeting was chaired by Financial Markets Authority Chief Executive Samantha Barrass. The Council discussed the ongoing work on scanning the horizon for the financial sector and the progress made across the five priority themes. The Council also agreed changes to the CoFR banking and insurance forums to make them more effective and inclusive.

17 December 2024

Photo credit: rawpixel.com

Regulatory Initiatives Calendar - Q4 2024

The Council of Financial Regulators has released the Q4 2024 update to the Regulatory Initiatives Calendar for New Zealand’s financial sector. This document is produced to help the sector understand the aggregate picture of regulatory initiatives from CoFR members that are either planned or under way. The next update is planned for the end of March.

13 December 2024

Photo credit: rawpixel.com

Regulatory Initiatives Calendar - Q3 2024

The Council of Financial Regulators has released an updated Regulatory Initiatives Calendar for New Zealand’s financial sector for Q3 2024. This document is produced to help the sector understand the aggregate picture of regulatory initiatives from CoFR members that are either planned or under way. The next update is planned for mid December.

30 September 2024

Quarterly Statement by the Council of Financial Regulators – August 2024

The Council of Financial Regulators (CoFR) held its quarterly meeting on Tuesday 27 August 2024. The meeting was chaired by the Chief Executive of the Financial Markets Authority Samantha Barrass. The focus of the meeting was the final report of the Commerce Commission’s market study into personal banking services. The Council also took time to share their individual agency priorities and received an update on the work on basic bank accounts.

30 August 2024

Photo by jcomp on Freepik

Market study into personal banking services – final report

The Commerce Commission, Te Komihana Tauhokohoko, has published its final report following its market study into personal banking services. The report makes a suite of recommendations for improving competition in this market, designed to work together to support new entry and expansion, reduce the regulatory barriers to competition and empower consumers to get better prices and services.

20 August 2024

Quarterly Statement by the Council of Financial Regulators – August 2024

The Council of Financial Regulators (CoFR) held its quarterly meeting on Tuesday 27 August 2024. The meeting was chaired by the Chief Executive of the Financial Markets Authority Samantha Barrass. The focus of the meeting was the final report of the Commerce Commission’s market study into personal banking services. The Council also took time to share their individual agency priorities and received an update on the work on basic bank accounts.

30 August 2024

Financial regulators and industry representatives set vision for New Zealand’s insurance sector

The Council of Financial Regulators (CoFR) Insurance Forum has set a vision for New Zealand’s insurance sector. The vision is for a sector that is forward-looking, fair, stable, competitive and efficient, promoting informed and confident participation by consumers and business.

8 August 2024

Photo credit: rawpixel.com

Regulatory Initiatives Calendar - Q2 2024

The Council of Financial Regulators has released an updated Regulatory Initiatives Calendar for New Zealand’s financial sector for Q2 2024. This document is produced to help the sector understand the aggregate picture of regulatory initiatives from CoFR members that are either planned or under way. The next update is planned for end September.

27 June 2024

Quarterly Statement by the Council of Financial Regulators – June 2024

The Council of Financial Regulators (CoFR) held its quarterly meeting on Wednesday 5 June 2024. The meeting was chaired by the Governor of the Reserve Bank of New Zealand Adrian Orr. The Council discussed the current focus of each of the CoFR members, noted the progress being made across each of the five identified priority themes for the financial system, and discussed the priorities and challenges for the general insurance sector with the CEO of the Insurance Council of NZ.

7 June 2024

Photo credit: rawpixel.com

Regulatory reforms announced – updated RIC

On Sunday 21 April 2024 the Minister of Commerce and Consumer Affairs, Andrew Bayly, and the Minister of Housing, Chris Bishop, announced a two-phased package of reforms to streamline financial services, with consultation papers to be released in the coming weeks.

We have published an updated CoFR Regulatory Initiatives Calendar (RIC) to reflect these changes.

For more details on the announced reforms see Ministers’ announcement and MBIE financial services reforms page

22 April 2024

Photo by Eduardo Soares on Unsplash

Consultation opens on a digital currency for New Zealand

The Reserve Bank of New Zealand (RBNZ) has published a consultation paper, Digital Cash in New Zealand. The RBNZ is sharing its latest thinking on what digital cash could look like in New Zealand, how New Zealanders could use it and what benefits it could bring. This is part of the work required to deliver CoFR’s vision for the future of New Zealand’s payments landscape.

The consultation is open until 26 July 2024.

18 April 2024

Op-Ed: A trusted, inclusive, resilient, and competitive financial system

The following op-ed by Council of Financial Regulators co-chair and RBNZ Governor Adrian Orr was published in the New Zealand Herald on Monday 1 April 2024.

2 April 2024

Photo credit: rawpixel.com

Regulatory Initiatives Calendar - Q1 2024

The Council of Financial Regulators has released an updated Regulatory Initiatives Calendar for the financial sector for Q1 2024. This document is produced to help the sector understand the aggregate picture of regulatory initiatives from CoFR members that are either planned or under way.

28 March 2024

Quarterly Statement by the Council of Financial Regulators – March 2024

The Council of Financial Regulators (CoFR) held its quarterly meeting on Thursday 7 March 2024. The meeting was chaired by the Governor of the Reserve Bank of New Zealand Adrian Orr. The Council discussed the work programme and priorities of the new Government; the challenges posed by climate change with the Chairperson of the Climate Change Commission; and assessed the current state of New Zealand’s payments landscape against the vision it set out in July 2023.

12 March 2024

Photo credit: rawpixel.com

Regulatory Initiatives Calendar - Q4 2023

The Council of Financial Regulators has released an updated Regulatory Initiatives Calendar for the financial sector for Q4 2023. This document is produced to help the sector understand the aggregate picture of regulatory initiatives from CoFR members that are either planned or under way.

15 December 2023

Quarterly Statement by the Council of Financial Regulators – December 2023

The Council of Financial Regulators (CoFR) held its quarterly meeting on Tuesday 12 December 2023. The meeting was chaired by Financial Markets Authority Chief Executive Samantha Barrass. The Council discussed the work programme of the new Government; progress made across CoFR’s five priority themes: Regulatory Effectiveness, Cyber Resilience, Financial Inclusion, Climate-related risks, and Digital and Innovation; system-wide risks, trends and gaps; and received an update on the insurance sector.

15 December 2023

Photo credit: freepik, teksomolika

Financial Inclusion

Financial Inclusion is one of CoFR’s five priority themes. Recent publications in this area include the RBNZ’s Approach to Financial Inclusion and a joint message from the FMA and the Commerce Commission on supporting customers in financial difficulty.

31 October 2023

Photo credit: rawpixel.com

Regulatory Initiatives Calendar - Q3 2023

The Council of Financial Regulators has released an updated Regulatory Initiatives Calendar for the financial sector for Q3 2023. This document is produced to help the sector understand the aggregate picture of initiatives from CoFR members that are either planned or under way.

29 September 2023

Photo by Mourad Saadi on Unsplash

Climate-related risks update

Climate-related risks is one of the Council of Financial Regulators’ (CoFR’s) five priority themes. CoFR has produced a one-page diagram which sets out the ongoing activities of each CoFR member in relation to this priority theme. This diagram is designed to help the sector understand who is responsible for what and demonstrates how the different activities fit alongside one another. A community of subject matter experts regularly meets to coordinate and cooperate in relation to these activities.

7 September 2023

Quarterly Statement by the Council of Financial Regulators – October 2023

The Council of Financial Regulators (CoFR) held its quarterly meeting on Thursday 5 October 2023. The meeting was chaired by Reserve Bank of New Zealand Governor Adrian Orr. The Council discussed the current regulatory approach to protecting New Zealanders from financial scams, the regulatory approach to the credit unions and building societies sector, the Council’s coordinated approach to improving financial inclusion, and how the Council could better achieve and measure success in terms of its legislative mandate and the principles of good regulatory stewardship.

10 October 2023

Photo by Eduardo Soares on Unsplash

Financial regulators set vision for New Zealand payments landscape

New Zealand’s payments landscape should offer “reliable and efficient payments that better meet the evolving needs of all New Zealanders”, says the Council of Financial Regulators (CoFR) in a vision statement released today. “The vision statement provides a focal point for both agencies and the payments industry as we plan, influence, innovate, co-ordinate, and track Aotearoa’s progress towards it.”

27 July 2023

Photo credit: rawpixel.com

Regulatory Initiatives Calendar - Q2 2023

The Council of Financial Regulators has released an updated Regulatory Initiatives Calendar for the financial sector for Q2 2023. This document is produced to help the sector understand the aggregate picture of initiatives from CoFR members that are either planned or under way.

30 June 2023

Quarterly Statement by the Council of Financial Regulators – May 2023

The Council of Financial Regulators (CoFR) held its quarterly meeting on Wednesday 31 May 2023. The meeting was chaired by Financial Markets Authority Chief Executive Samantha Barrass. The Council discussed the regulatory agenda for the insurance sector, the future of New Zealand’s payments landscape, the combined efforts to ensure proportionate regulation of New Zealand’s financial system, joint work on Māori access to capital, and the Commerce Commission’s experience with market studies.

31 May 2023

Photo credit: rawpixel.com

Regulatory Initiatives Calendar - Q1 2023

The Council of Financial Regulators has released an updated Regulatory Initiatives Calendar for the financial sector for Q1 2023. This document is produced to help the sector understand the aggregate picture of initiatives from CoFR members that are either planned or under way. CoFR members are mindful of the operational impact on the insurance sector of the recent severe weather events and will continue to consider implications for the initiatives contained in this calendar.

10 March 2023

Quarterly Statement by the Council of Financial Regulators - March 2023

The Council of Financial Regulators (CoFR) held its quarterly meeting on Thursday 9 March 2023. The Council discussed their role in responding to the recent severe weather events and work underway to deepen co-operation and co-ordination across CoFR agencies more broadly. They also discussed the Reserve Bank's work plan to explore a central bank digital currency and the Commerce Commission’s work on retail payments system regulation.

10 March 2023

Photo credit: rawpixel.com

Regulatory Initiatives Calendar Q4 2022 and Feedback Statement on Proposals for Enhancements

The Council of Financial Regulators (CoFR) has released an updated Regulatory Initiatives Calendar for the financial sector for Q4 2022. CoFR has also released a statement that summarises the feedback provided by the financial services sector on CoFR’s proposals for enhancing the quarterly calendar.

15 December 2022

Quarterly Statement by the Council of Financial Regulators – December 2022

The Council of Financial Regulators (CoFR) held its quarterly meeting on Monday 12 December 2022. The Council took this opportunity to review the progress made over the course of the year, including on each of its priority themes, and to endorse plans for 2023.

15 December 2022

Photo by Kanchanara on Unsplash

Cryptoassets: a statement from the Council of Financial Regulators

The Council of Financial Regulators (CoFR) has today released a statement regarding cryptoassets. CoFR notes that cryptoassets and their underlying technologies such as distributed ledger technology (i.e. blockchain technology) and cryptography are being used to develop new and innovative financial products and services. CoFR welcomes the continued exploration of how these technologies can support greater competition and more innovation in financial services, while noting the rise of cryptoassets poses additional risks.

2 September 2022

Council of Financial Regulators: meeting on 31 August 2022

The Council of Financial Regulators (CoFR) met on Wednesday 31 August 2022. The Council discussed how its agencies could further enhance collaboration when setting priorities for regulatory initiatives, the shared goals and success measures for each of CoFR’s priority themes, and public messaging regarding cryptoassets.

2 September 2022

Photo credit: rawpixel.com

Regulatory Initiatives Calendar - Quarter 3 2022

The Council of Financial Regulators has released an updated Regulatory Initiatives Calendar for the financial sector for Q3 2022. This document is produced to help the sector understand the aggregate picture of initiatives from CoFR members that are either planned or under way.

2 September 2022

Financial Markets (Conduct of Institutions) Amendment Act (CoFI)

The Government has introduced a new regulatory regime to govern conduct in the financial sector. The Financial Markets (Conduct of Institutions) Amendment Act 2022 received royal assent on 29 June 2022. The Act requires banks, insurers and non-bank deposit takers to have the right systems in place for ensuring they treat their customers fairly.

5 July 2022

Reserve Bank of New Zealand Act 2021

The Reserve Bank of New Zealand Act 2021 comes into force today. Sections 285-288 of the Act provide statutory recognition for the Council of Financial Regulators and its function to ‘facilitate co-operation and co-ordination between members of the council to support effective and responsive regulation of the financial system in New Zealand.’ This recognises the ongoing importance of CoFR’s work.

1 July 2022

Emissions Reduction Plan

New Zealand’s first Emissions Reduction Plan was published on 16 May 2022. It contains strategies, policies and actions for achieving our first emissions budget and contributing to global efforts to limit global temperature rise to 1.5˚C above pre-industrial levels. The financial sector has a key role in the transition to a low-carbon economy. For example, climate-related risk reporting for some listed companies and financial institutions supports the consideration of climate change in business decisions, helping the market to allocate investments in a way that contributes to a low-emissions and climate resilient economy.

23 May 2022

Regulatory Initiatives Calendar

The Council of Financial Regulators has released an updated Regulatory Initiatives Calendar for the financial sector for Q2 2022. This document is produced to help the sector understand the aggregate picture of initiatives from CoFR members that are either planned or under way.

2 June 2022

Council of Financial Regulators: meeting on 31 May 2022

The Council of Financial Regulators met on 31 May 2022. The Council discussed cross-agency protocols during a cyber incident, system-wide risks and opportunities in relation to crypto-assets, and the coordination of monitoring activities across CoFR members. The Council also received an update on the investigation into recent changes in the Credit Contracts and Consumer Finance Act (CCCFA), efforts to address price inflation, and reflected on the continuing situation in Ukraine and risks related to the COVID-19 pandemic.

2 June 2022

Draft National Adaptation Plan

Climate change is already affecting the economy of New Zealand. It is increasing existing risks, such as floods and droughts, and has resulted in sea-level rise. The Government is consulting on a draft National Adaptation Plan for how New Zealand can adapt to and minimise the harmful impacts of our changing climate. The draft National Adaptation Plan outlines the actions the Government will take over the next six years to respond to the 2020 National Climate Change Risk Assessment. The financial sector can support investment in adaptation across the economy, and also has a key role in ensuring its own resilience to a changing climate.

23 May 2022

Photo credit: freepik, tirachardz

Council of Financial Regulators: meeting on 1 March 2022

The Council of Financial Regulators met on 1 March 2022. The council discussed the regulatory agenda for 2022, cyber resilience in the financial sector, the investigation into recent changes in the Credit Contracts and Consumer Finance Act, and the impact for New Zealand’s financial sector of the developing situation in Ukraine.

3 March 2022

Regulatory Initiatives Calendar

The Council of Financial Regulators has released an updated Regulatory Initiatives Calendar for the financial sector. This document is produced to help industry understand the aggregate picture of initiatives from CoFR members that are either planned or under way.

3 March 2022

COVID-19 and the Financial Sector

New Zealand is operating under the COVID-19 Protection Framework.

Financial services firms should follow the appropriate COVID-19 guidance for business.

At each of the three phases of the Omicron response, there are different requirements for businesses, including testing and how long cases need to isolate for. During phases Two and Three, the Close Contact Exemption Scheme will operate to ensure critical services can continue to function.

CoFR continues to meet regularly to discuss the impact of COVID-19 and consider ways to support the industry in tackling the challenges it presents.

11 February 2022

Credit Contracts and Consumer Finance Act

An investigation into the initial implementation of recent changes to the Credit Contracts and Consumer Finance Act 2003 (CCCFA) that came into force on 1 December 2021 is under way. This investigation will be led by MBIE in collaboration with CoFR agencies. The Terms of Reference for this investigation were released on 31 January 2022.

3 February 2022

Photo credit: freepik, tirachardz

Council of Financial Regulators: meeting on 30 November 2021

The Council of Financial Regulators (CoFR) met on 30 November 2021 at the Treasury. The group discussed cyber resilience, the role of credit unions and building societies, CoFR’s ongoing work on conduct and governance and financial inclusion, and the forthcoming meeting of the Trans-Tasman Banking Council.

2 December 2021

Photo credit: rawpixel.com

Regulatory Initiatives Calendar

The Council of Financial Regulators has released an updated Regulatory Initiatives Calendar for the financial sector. This document is produced to help industry understand the aggregate picture of initiatives from CoFR members that are either planned or under way, including details of a summer break in engagement with the industry.

12 November 2021

CoFR publishes FinTech roadmap

The CoFR FinTech group has developed a set of business and regulation related information designed to help FinTechs operating in New Zealand.

The guide sets out how fintech fits within the current regulatory regime, and should support improved regulatory coordination.

The guide is available on the fintech.govt.nz site.

5 November 2021

RBNZ releases Climate Changed 2021 & Beyond

Te Pūtea Matua - Reserve Bank of New Zealand has released Climate Changed 2021 & Beyond, our report on our climate change strategy and work. This report outlines its actions to mitigate and manage the significant economic risks associated with climate change. This is the first significant report that we have released since launching our Climate Change Strategy in 2018.

26 October 2021

CoFR celebrates significant milestones

There are big changes under way for the Council of Financial Regulators (CoFR) as it marks its tenth birthday. Its five members have signed a new Memorandum of Understanding, its first full-time adviser has come on board and its vital role has been recognised in legislation.

11 October 2021

Council of Financial Regulators: meeting on 31 August 2021

The Council of Financial Regulators (CoFR) met on 31 August 2021. The meeting took place online due to Level 4 restrictions. The group discussed the impacts of the Covid-related lockdown and the extensive engagement there has been with the financial services industry.

3 September 2021

CoFR role to be mandated under new legislation

CoFR will receive statutory recognition in July next year through the Reserve Bank of New Zealand Act 2021, which has just passed its third and final reading.

As well as strengthening the way the Reserve Bank operates and is governed, the legislation gives CoFR a mandate to support effective and responsive regulation of New Zealand’s financial system.

11 August 2021

Photo credit: rawpixel.com

Timetable of Regulatory Initiatives

CoFR has released an updated timetable for regulatory initiatives affecting the financial sector, covering plans for the rest of 2021 and throughout 2022.

10 August 2021

Photo credit: freepik, tirachardz

Cross-sector thematic review on governance

The Reserve Bank of New Zealand (RBNZ), Te Pūtea Matua and the Financial Markets Authority (FMA), Te Mana Tātai Hokohoko will be working together to conduct a cross-sector thematic review on governance, covering banks, insurers, non-bank deposit takers and investment management firms. The review will focus on the boards of regulated entities and their ability to effectively govern and provide oversight.

9 August 2021

Photo credit: freepik, liuzishan

New FinTech Forum website launched

Innovation thinking, enabled by tech adoption, creates benefits for consumers, businesses and New Zealand. The new FinTech forum website – CoFR’s official forum for FinTech-related regulation – launched on 19 July. It is a single point for FinTech regulatory enquiries directed at any of our member agencies.

19 July 2021

Photo credit: freepik

Fit and Proper Person certification

The Commerce Commission’s Fit and Proper Person certification regime went live on 1 June 2021 with certification of directors and senior managers of consumer credit providers becoming compulsory from 1 October 2021.

Commerce Commission, 1 June 2021

Photo credit: freepik, teksomolika

Government announces plans to reduce merchant service fees

The Government to reduce merchant service fees, that banks charge businesses when customers use a credit or debit card to pay.

12 May 2021

Photo credit: freepik, senivpetro

CoFR releases consumer vulnerability framework

CoFR has agreed on a common understanding of the characteristics of a vulnerable consumer. This framework serves as a guideline to help industry in developing their own approaches to assisting vulnerable consumers.

CoFR, 30 April 2021

Photo credit: freepik, evening_tao

Government introduces legislation to Parliament on climate-related disclosures

The Bill will make climate-related disclosures mandatory for most listed issuers, large registered banks, licensed insurers and managers of investment schemes.

MBIE, 13 April 2021

Reserve Bank publishes report on Māori Economy

This report on the Māori economy was produced by BERL, commissioned by RBNZ - Te Pūtea Matua in 2020. It expands on their 2013 report, providing a rich description of the many roles Māori play in the economy of Aotearoa New Zealand.

RBNZ, 28 January 2021